Ct tax paycheck calculator

Paycheck Results is your gross pay and. Tax Calculators Tools Tax Calculators Tools.

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

If you make 70000 a year living in the region of Connecticut USA you will be taxed 11687.

. More specifically up until 1991 only capital gains interest and dividends. Connecticut Income Tax Calculator 2021. Calculating paychecks and need some help.

2021 Social Security Benefit Adjustment Worksheet. All you need to do to access that light is enter wage and W-4 information for each employee and our payroll tax calculator will calculate all the Connecticut and Federal payroll. The Connecticut Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Connecticut.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. SmartAssets Connecticut paycheck calculator shows your hourly and salary income after federal state and local taxes. Use this calculator to determine your Connecticut income tax.

Menu burger Close thin. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Connecticut residents only. Just enter the wages tax withholdings.

Select the filing status as checked on the front of your tax return and enter your Connecticut Adjusted Gross Income. After a few seconds you will be provided with a full. Connecticut Paycheck Calculator Use ADPs Connecticut Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

To use our Connecticut Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. How to calculate annual income. Connecticuts personal income tax is a relatively recent development.

Your average tax rate is 1198 and your marginal. Connecticut Paycheck Calculator Find out how much your take home pay is after income tax so you can have a better idea of what to expect when planning your budget 7 Ratings Optional. Connecticut Hourly Paycheck Calculator Results Below are your Connecticut salary paycheck results.

Calculate your Connecticut net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Connecticut. The Federal or IRS Taxes Are Listed. For example if an employee earns 1500.

Connecticut Connecticut Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Connecticut. Monthly Connecticut Withholding Calculator - CT.

The Connecticut Tax Calculator Lets You Calculate Your State Taxes For the Tax Year. 2021 Property Tax Credit Calculator. Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax.

This calculator is intended to be used as a tool to calculate your monthly Connecticut income tax withholding. This Connecticut paycheck calculator will give you a full breakdown of your paycheck by entering the total amount of income tax state and federal taxes and deductions. Enter your info to see your take home pay.

Connecticut Income Taxes. It is not a substitute for the. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

The results are broken up into three sections. Enter your withholding code from Form CT-W4P Line 1. 2021 Income Tax Calculator.

Peoplesoft Payroll For North America 9 1 Peoplebook

How To Calculate Connecticut Income Tax Withholdings

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

How To Calculate Connecticut Income Tax Withholdings

:max_bytes(150000):strip_icc()/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Paycheck Tax Withholding Calculator For W 4 Tax Planning

What Is Local Income Tax Types States With Local Income Tax More

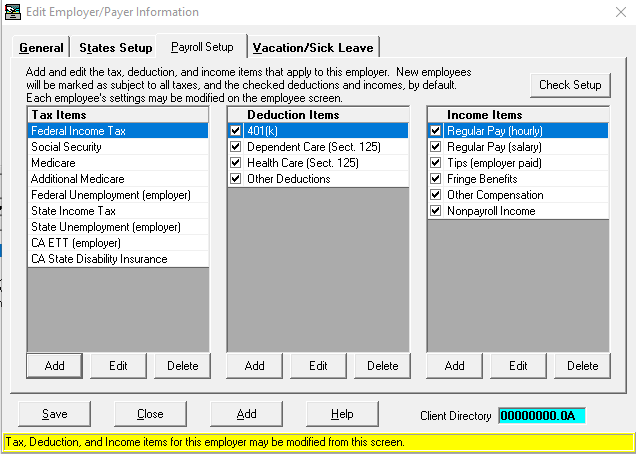

Setting Up Paycheck Items Cfs Tax Software Inc

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

Connecticut Paycheck Calculator Adp

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Connecticut Paycheck Calculator Smartasset

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Connecticut Paycheck Calculator Smartasset

29 Free Payroll Templates Payroll Template Invoice Template Payroll

Payroll Tax Calculator For Employers Gusto